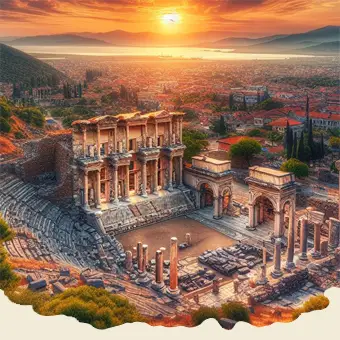

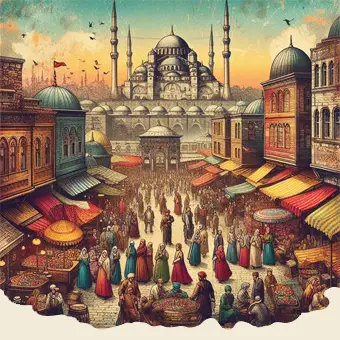

Discover both hidden gems and all the top destinations

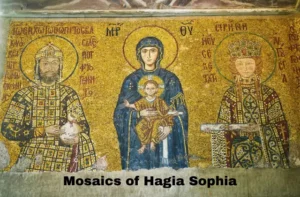

Trip Turkey is a niche travel blog which consists of experiences. You can find all the current tips for destinations, notable things to do’s, hotels guide for your next holiday. Explore the unique local cuisines, best beaches in Turkey, museums, historical sites, golf courses, tour packages, boat trips, top attractions, weather and even more deals in this Turkey travel blog.